The Challenges

There are numerous reports by established research agencies on the UK payments landscape. Despite giving a direction and an indication of consumer’s financial holdings and payment behaviour, they fail to provide the depth and breadth needed to truly understand consumer’s perceptions, attitudes, and actual behaviour. The payments industry is complex; and a multitude of factors affect how consumers pay, such as:

- Personal factors – age, life-stage, and affluence.

- Financial factors – personal financial situation, financial holdings, financial institutions, and their product offerings.

- Financial evolution of the consumer – sequence and ‘ageing’ of acquisition of payment modes.

- Business environment – consumer confidence, merchant acceptance, technology, and digital adoption.

Therefore, it is challenging to get a complete view of the payments landscape. The intricacies of the four-party payment model (consumers, payment brands, banks, and merchants) mean that each stakeholder only sees the data they collect and never gets to understand the full picture.

Within the plethora of data sources used across Visa and its clients, there was no single source which looked holistically at consumer financial portfolios. Typically, there was a focus on one aspect e.g. debit or credit and therefore a gap in our understanding of consumers payments in their entirety.

The challenge was to develop a single, robust view of the consumer payments landscape that can be used by the entire UK Visa business and all clients.

Additionally, there was a second challenge in the methods of research used. Traditional qualitative methods rely on claimed behaviour which has a lag between the actual event and reporting it, which leads to inaccurate and rationalised biases. Quantitative methods give an in-depth understanding of what is occurring, but little context as to why and again included biases as consumers are forced to re-evaluate and rationalise their behaviour.

The Project

Brandscapes designed the Consumer Payment Landscape (CPL) research with Visa to overcome these shortcomings. Given the multitude of data sources already existing in Visa, it was important for the research to build on what Visa and its clients already knew, and bring all internal stakeholders onto the same ‘page’ through a multi-lens approach.

The goal of the research programme was to build the most comprehensive and detailed view of the UK payment landscape by understanding consumers ‘real’ payment attitudes and behaviours.

“It was critical from the outset that the research built upon existing knowledge whilst gathering new intelligence to create an unbiased view of the UK payment landscape. We needed a solution that triangulated existing datasets with extensive quantitative results of real-time purchasing behaviour along with a qualitative perspective to provide a true 360-degree view of the payment landscape.” Damion Lawrence, European Head of Research & Insights, Visa Europe

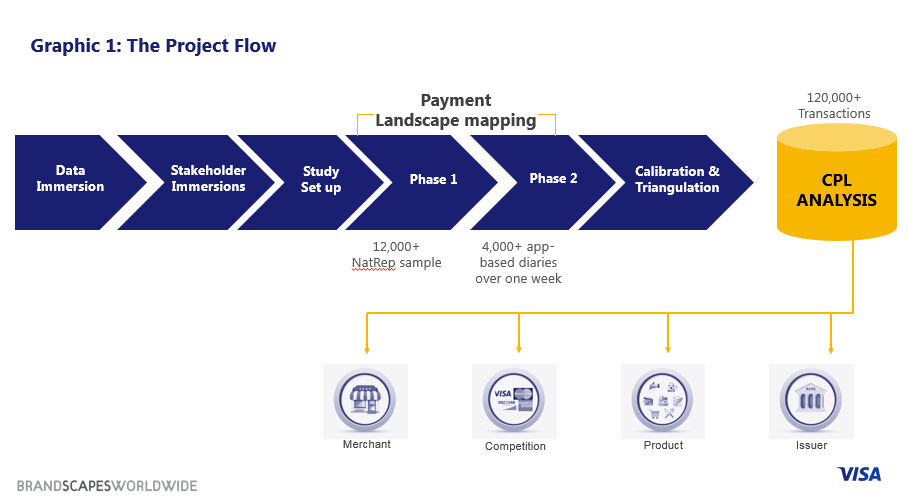

As befits such an ambitious exercise, a multi-stage and multi-modal approach was designed as shown in Graphic 1.

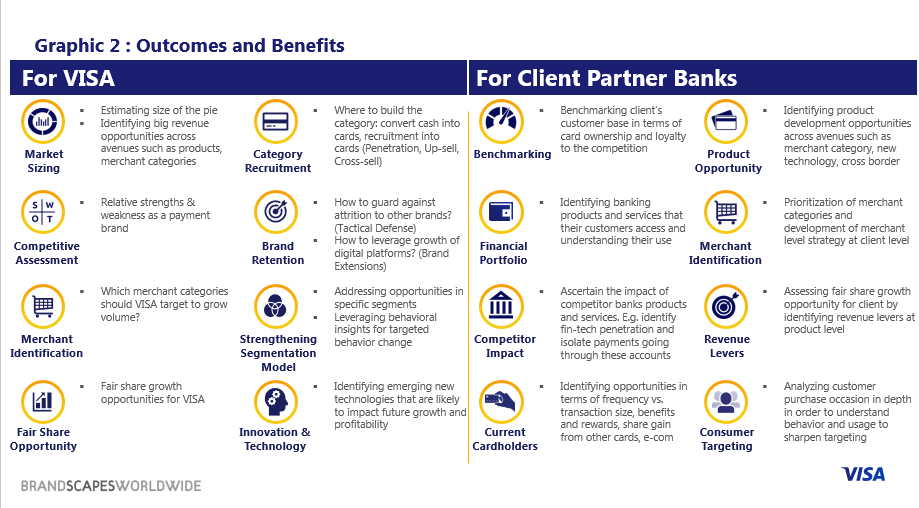

The outcomes and benefits of the studies to Visa and their client partners were clearly outlined. See Graphic 2.

Stage 1: Immersions

1A: Data immersion:

A comprehensive evaluation of published and internal data and reports, including consumer finance media, industry estimates and reports by regulators/ industry bodies, third-party research, Visa’s past research and internal transaction database.

1B: Stakeholder Immersions:

Extensive discussions with different stakeholders in Visa ranging from Marketing, Consulting, Product & Propositions, Merchant Solutions to Strategy.

- The regulatory environment for payments and FinTech.

- The structure of the market, including new-age tech solutions that are increasingly becoming mainstream.

- Consumer attitudes, media usage and segments.

- Industry perspective of the key challenges and the likely shape of the future.

- The decisions that the CPL was to inform across these diverse internal stakeholders such as the key challenges faced by Visa’s bank partners, product design.

“We were able to use the immersion sessions to understand the key priorities of the research and how it would be applied to the business, both for Visa and its clients. For example, a key criterion of success for this project was the ability to overlay the data onto the multiple segmentations that are used across Visa, and this was an outcome of the immersion discussions”. Kulvir Benning, Marketing and Insights Manager, Visa Europe.

This stage also, importantly, served to disseminate the need for and value of the study within Visa and generated internal buy-in for the project.

Stage 2: Mapping the Payments Landscapes

This was in two phases:

- A large-scale nationally representative sampling of over 12,000 individuals residing in the UK covered consumers’ banking habits, card ownership and usage, outbound travel payments, infrequent and periodic payments.

- An app-based mobile diary was placed for a week among a sub-sample of over 4,000 consumers. Quotas were built into the sample to ensure robust reads for segments of special focus.

The diary and follow-ups were designed to capture details of over 120,000 payment and ATM transactions in real-time: what was bought, how was the payment made, why the payment mode was used and so on. The data from phase 1 enabled accurate attribution of the payment mode to enable us to cut the data in several ways including payment mode (cash, card, contactless, digital…), the bank issuing the card, merchant category where the payment was made, reasons for using specific card/ payment mode (or not), transaction amount and so on.

Stage 3: Calibration and triangulation

The data capture phase was followed by a crucial part of the project. The data captured through the two phases was consolidated, weighted, projected, and then calibrated and triangulated with external and internal data available from the immersion phase and with Visa’s databases. The result is a database that is not only unparalleled in its size and detail but also robust and reliable in terms of the payment volume of the various segments.

Outcomes Achieved:

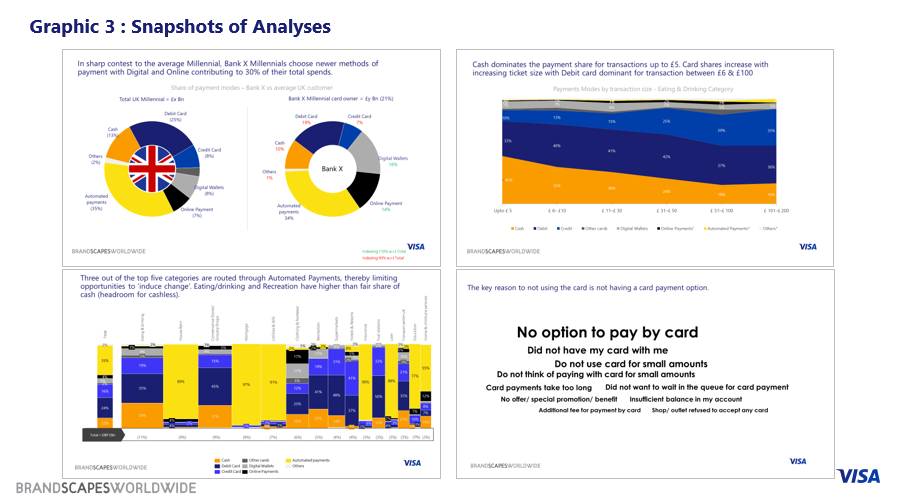

The Consumer Payments Landscape study data has been analysed using different lenses such as card-issuing banks, merchant categories, product (e.g. credit Vs. debit). We analysed the data to help facilitate discussions between Visa and their client partners and co-creating strategic and tactical initiatives. For confidentiality reasons, we are unable to name these partners or go into specific details, but some examples of the analyses are listed below, and snapshots are shown in Graphic 3.

- Identification of opportunities and assessing threats for ‘traditional’ banks such as from nascent “neobanks”.

- Propensity modelling to pinpoint the kind of customer most likely to convert to neobanks.

- Identification and characterisation of opportunities for Visa in each consumer segment, age cohort, affluence level, regions.

- Assessment of Visa’s strengths, weaknesses, and vulnerabilities.

- Reassessing and sharpening Visa’s consumer segmentation with behavioural information from the CPL to feed into targeting strategies.

- Designing products and rewards to resonate with key consumer segments of partner banks.

- Informing the cross-selling strategies of partner banks.

- Driving merchant category strategy for both Visa and their partner banks.

The multi-lens approach has resulted in analyses that cover different facets of the business

- Partner Banks

- Cash Displacement

- Acceptance

- Product Design: Debit, Credit, Contactless, Digital Wallets

- Consumer migration up the value chain

- Cross-selling

- Up-selling

- Share gain

- Consumer Segmentation and Targeting

- Communication

Further, Visa’s partner banks have expressed the desire to do follow-up work to hone-in into the implications thrown up by this exercise and different internal teams are developing propositions and service ideas specific to micro-segments.

“The CPL study has provided immensely valuable insights into the changing shape of the UK payments landscape! The study has allowed us to understand the full range of payment methods used by consumers, the relationship with their main bank versus other providers and most importantly the drivers for this. These insights are currently supporting the development of new propositions that will meet the differing needs of consumers taking account of their life stage and affluence”. Geoff Mozley, Commercial Account Manager, Visa UK.

Why should this entry win the award?

- Innovation in the use of newer technology-based methodologies to ensure near real-time, accurate responses.

- Proven validity of the data through calibration and triangulation.

- Building on existing knowledge and practices such as the incorporation of multiple segmentations into the study to allow for flexible analysis.

- Alignment of all internal stakeholders on objectives, outcomes, and design prior to designing the questionnaire.

- The research enabled Visa to have a single market view across internal departments as well as external stakeholders.

“Visa has to navigate an evolving and subtle payments space. When we develop programs to encourage behaviour change, we need to be consumer-led. We need to understand the environment within which consumers make their decisions and this study enables us to do this. I see this as the first of a series of studies that will ultimately explore other audiences including merchants/ retailers plus wider SME/ business owners. Very excited by this first phase of our roadmap and look forward to sharing observations and recommendations with our partners.” Neil Rycraft, Head of Marketing Strategy & Operations, Visa Europe